The Statistics of Mortality

Understanding How Men Die in America

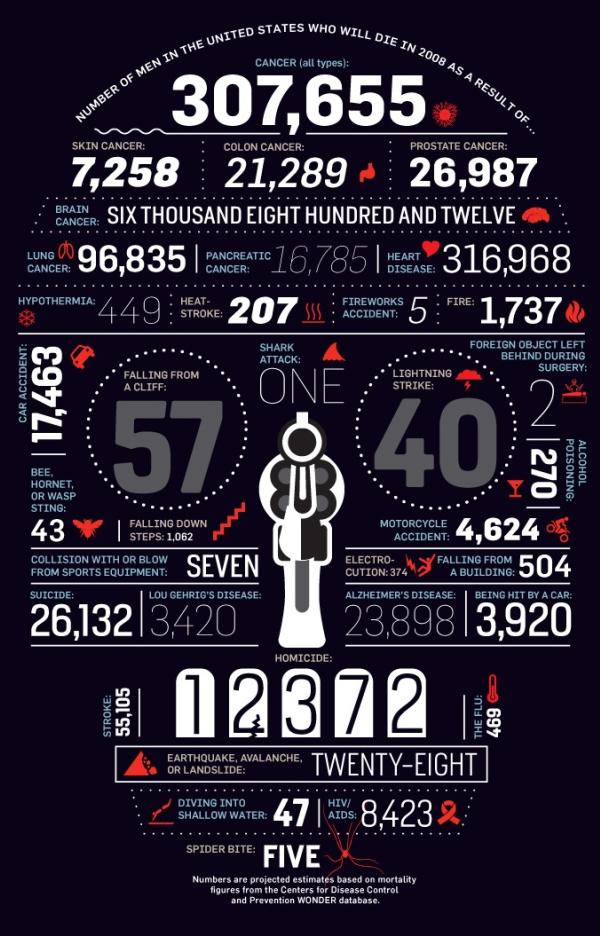

The stark infographic above presents a sobering look at the causes of death for men in the United States in 2008. While we often fear the sensational – shark attacks, lightning strikes, or spider bites – the data reveals a different reality about what truly threatens men’s lives.

This visualization puts into perspective both the major killers and the statistical rarities, challenging us to reconsider our perception of risk.

The Major Killers

Cancer Breakdown

Other Significant Causes

Putting Risk in Perspective

While we often fear the dramatic and sensational causes of death, the data tells us that lifestyle-related diseases like cancer and heart disease pose a far greater risk. Media coverage and popular culture may fuel our fear of sharks or lightning, but the statistics reveal a different reality.

Unexpected Significant Risks

Why These Statistics Matter

Understanding the true causes of mortality can help us make better decisions about our health and safety. The data suggests that we should focus our preventive efforts on:

- Regular health screenings for common cancers, especially prostate, colon, and lung

- Heart health maintenance through diet, exercise, and medical monitoring

- Mental health awareness to address the significant suicide rates

- Vehicle safety, particularly for motorcyclists

While it’s natural to fear the dramatic and unusual, the statistics show that our attention and preventive efforts are better directed toward the less sensational but far more common causes of death.

Sources: American Cancer Society, CDC, National Safety Council (2008 data)

Join the Conversation

Were you surprised by any of these statistics? Has this information changed how you think about health risks? Share your thoughts in the comments below.