Why Chinese coffee giants are targeting America's $110 billion market with aggressive pricing and tech-first strategies that could reshape the entire industry The digital-first coffee revolution has arrived in America, led by Chinese innovations that prioritize speed, affordability, and technology over traditional cafe experiences. The American coffee industry just experienced an earthquake, and most people didn't even feel the tremor. On June 30, 2025, Luckin Coffee (the Chinese coffee giant that dethroned Starbucks in China)...

Tag: competitive advantage

She Showed Up Completely: 7 Life-Changing Lessons About Being Fully Present in Your Own Story

Sometimes the most powerful lesson comes not from getting a yes, but from someone recognizing the courage it took to ask View this post on Instagram A rejection that became the most empowering advice millions have ever heard Sophia didn't make it to the next round. In the traditional sense, her audition was a "failure." But what happened next has touched millions of people and delivered one of the most powerful life lessons ever captured...

From Baseball to Billions: How Smart Leaders Turn 90% Failure Rates Into Massive Success

Master Jeff Bezos's counterintuitive approach to business strategy that transforms calculated failures into extraordinary wins Taking bold swings in business requires the courage to fail repeatedly while aiming for transformational wins Imagine being told that the key to extraordinary business success is being wrong 90% of the time. It sounds absurd, doesn't it? Yet this counterintuitive philosophy has driven some of the most successful companies and leaders of our era, from Amazon's dominance in cloud...

The Tomorrow Trap: How One Word Kills More Dreams Than Failure Ever Could

Why the most innocent word in the English language is secretly destroying your biggest aspirations When tomorrow becomes never There's a word that appears in conversations millions of times every day. It seems harmless, even responsible. It suggests planning, consideration, and good intentions. Yet this single word has killed more dreams, destroyed more potential, and wasted more human talent than economic crashes, natural disasters, or any external obstacle you can imagine. That word is "tomorrow."...

The Success Trap: Why Yesterday’s Winners Become Tomorrow’s Losers (And How to Break the Cycle)

How the very achievements that made you successful can become the greatest threat to your future success When success becomes a prison instead of a platform There's a cruel irony embedded in human achievement: the very strategies that make us successful often become the primary obstacles to our continued success. The problem with success is that it teaches you the wrong lessons. What worked yesterday becomes religion, and religions don't adapt. This isn't just philosophical...

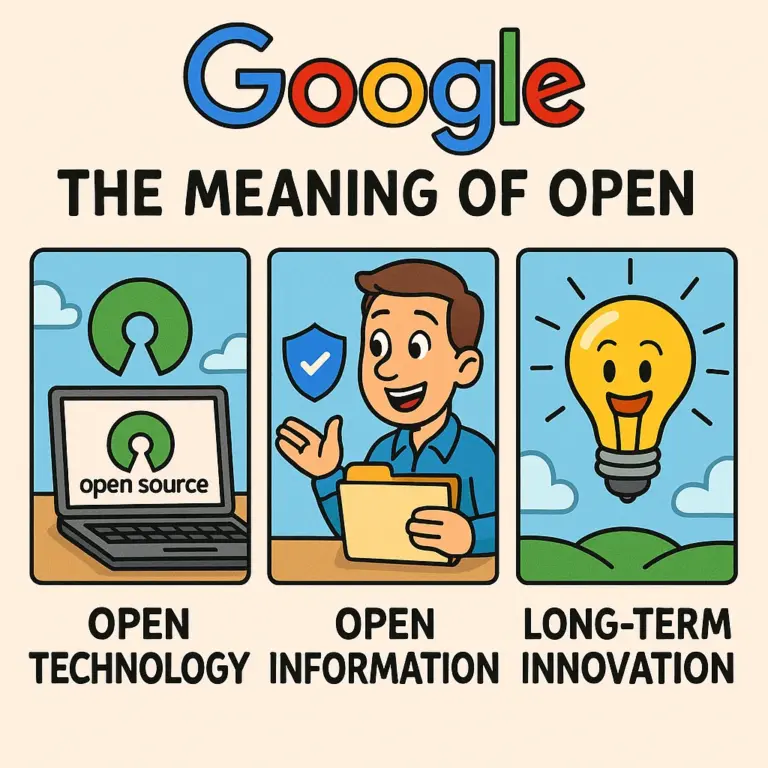

Google: The Meaning Of Open

I liked one of Google's recent blog posts about "The Meaning of Open". Summary of the Article At Google we believe that open systems win. They lead to more innovation, value, and freedom of choice for consumers, and a vibrant, profitable, and competitive ecosystem for businesses. There are two components to our definition of open: open technology and open information. Open technology includes open source, meaning we release and actively support code that helps grow...