The incredible entrepreneurial journey that transformed a grandmother's life savings into America's largest sporting goods retailer From a tiny bait shop to over 720 stores generating $13.4 billion annually In 1948, an 18-year-old high school graduate who barely made it through school stormed out of his job at an Army surplus store. His boss had just torn up his carefully crafted list of fishing equipment recommendations, calling him a "dumb kid who didn't know what...

Tag: Innovation

China’s Coffee Revolution Hits America: How Tech-First Chains Could Demolish the $110 Billion Coffee Industry

Why Chinese coffee giants are targeting America's $110 billion market with aggressive pricing and tech-first strategies that could reshape the entire industry The digital-first coffee revolution has arrived in America, led by Chinese innovations that prioritize speed, affordability, and technology over traditional cafe experiences. The American coffee industry just experienced an earthquake, and most people didn't even feel the tremor. On June 30, 2025, Luckin Coffee (the Chinese coffee giant that dethroned Starbucks in China)...

From Baseball to Billions: How Smart Leaders Turn 90% Failure Rates Into Massive Success

Master Jeff Bezos's counterintuitive approach to business strategy that transforms calculated failures into extraordinary wins Taking bold swings in business requires the courage to fail repeatedly while aiming for transformational wins Imagine being told that the key to extraordinary business success is being wrong 90% of the time. It sounds absurd, doesn't it? Yet this counterintuitive philosophy has driven some of the most successful companies and leaders of our era, from Amazon's dominance in cloud...

The Success Trap: Why Yesterday’s Winners Become Tomorrow’s Losers (And How to Break the Cycle)

How the very achievements that made you successful can become the greatest threat to your future success When success becomes a prison instead of a platform There's a cruel irony embedded in human achievement: the very strategies that make us successful often become the primary obstacles to our continued success. The problem with success is that it teaches you the wrong lessons. What worked yesterday becomes religion, and religions don't adapt. This isn't just philosophical...

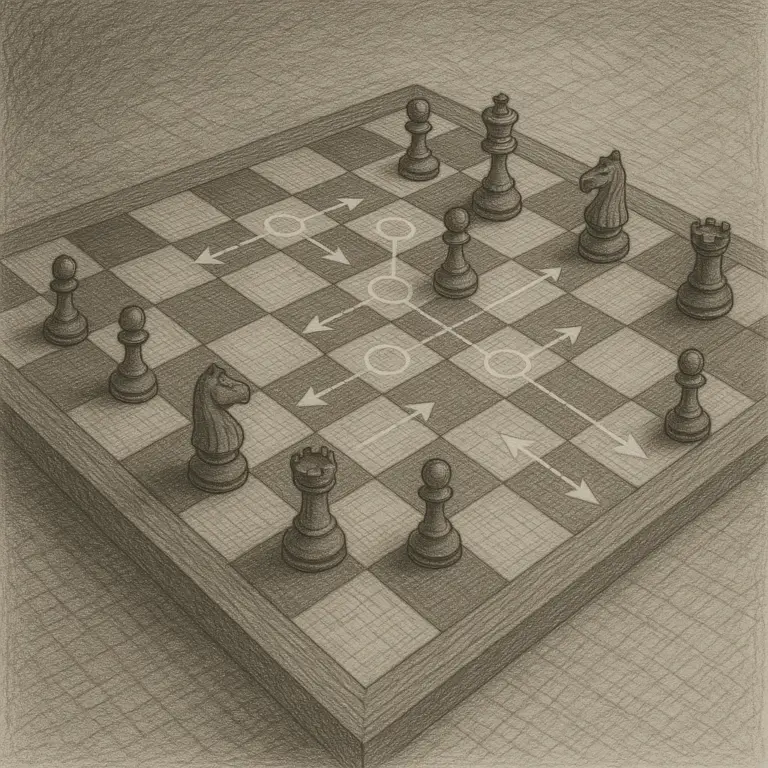

The Revolutionary Decision-Making Strategy That Amazon, Google, and Top Entrepreneurs Swear By

Why the world's most successful companies focus on making mistakes cheap rather than making them rare Strategy isn't about perfect moves—it's about quick adaptation Most people approach decision-making with a fundamental misunderstanding. They believe success comes from being right all the time—from making perfect decisions that never need correction. This mindset, while intuitive, is precisely what paralyzes individuals and organizations, preventing them from moving fast in uncertain environments. The world's most successful companies and entrepreneurs...

Fact-Checking David Sacks’ “1,000,000× in Four Years” AI Progress Claim

Analyzing the exponential acceleration in AI capabilities through advances in models, chips, and compute infrastructure The three vectors of AI advancement: algorithms, hardware, and compute scaling Venture capitalist David Sacks recently argued that artificial intelligence is on track for a million-fold (1,000,000×) improvement in four years, driven by exponential advances in three areas: models/algorithms, chips, and compute infrastructure. In a podcast discussion, Sacks stated that AI models are getting "3–4× better" every year, new hardware...