Master Jeff Bezos's counterintuitive approach to business strategy that transforms calculated failures into extraordinary wins Taking bold swings in business requires the courage to fail repeatedly while aiming for transformational wins Imagine being told that the key to extraordinary business success is being wrong 90% of the time. It sounds absurd, doesn't it? Yet this counterintuitive philosophy has driven some of the most successful companies and leaders of our era, from Amazon's dominance in cloud...

Tag: Jeff Bezos

The Tomorrow Trap: How One Word Kills More Dreams Than Failure Ever Could

Why the most innocent word in the English language is secretly destroying your biggest aspirations When tomorrow becomes never There's a word that appears in conversations millions of times every day. It seems harmless, even responsible. It suggests planning, consideration, and good intentions. Yet this single word has killed more dreams, destroyed more potential, and wasted more human talent than economic crashes, natural disasters, or any external obstacle you can imagine. That word is "tomorrow."...

The Success Trap: Why Yesterday’s Winners Become Tomorrow’s Losers (And How to Break the Cycle)

How the very achievements that made you successful can become the greatest threat to your future success When success becomes a prison instead of a platform There's a cruel irony embedded in human achievement: the very strategies that make us successful often become the primary obstacles to our continued success. The problem with success is that it teaches you the wrong lessons. What worked yesterday becomes religion, and religions don't adapt. This isn't just philosophical...

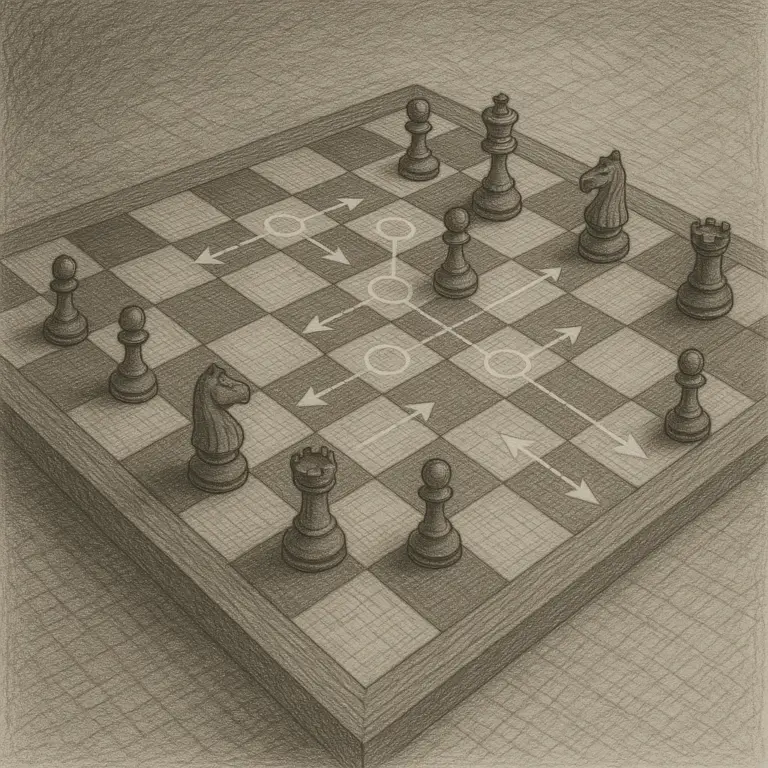

The Revolutionary Decision-Making Strategy That Amazon, Google, and Top Entrepreneurs Swear By

Why the world's most successful companies focus on making mistakes cheap rather than making them rare Strategy isn't about perfect moves—it's about quick adaptation Most people approach decision-making with a fundamental misunderstanding. They believe success comes from being right all the time—from making perfect decisions that never need correction. This mindset, while intuitive, is precisely what paralyzes individuals and organizations, preventing them from moving fast in uncertain environments. The world's most successful companies and entrepreneurs...

My Fascination With Amazon

The Visionary Strategies of Jeff Bezos Inside Amazon's massive warehouse operations For the future of retail, I'm sure you are looking at Amazon like everyone else is. I'm convinced the Internet will continue to disrupt traditional retail. Bezos is one of the most brilliant minds of our time, some say the next Jobs. I have tremendous respect for Bezos. Just a few of the things he's done... I'm sure I missed lots of things. I...