We’ve all heard the saying “a penny saved is a penny earned” but I don’t think too many people really stop and think about that. I read this and thought how true it is. Make smart decisions in life everyone. I’ve tried my best…sometimes it is easier said than done and life throws you a few curve balls to set you back. If I’ve learned one thing in life it is to expect the unexpected.

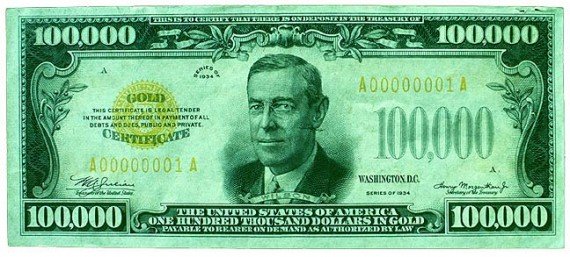

“At age 25, Jim makes $100,000 a year. He’s constantly traveling for business. He has a large home in which he often doesn’t visit some rooms for months at a time. He eats out every single night. He drives a leased Lexus, which he updates every few years at the end of the lease. He buys a whole new wardrobe every six months, taking the leftovers to Goodwill. He spends everything he brings in.

At age 25, Bill makes $35,000 a year. He lives in a smaller home and doesn’t travel much. He makes most of his own meals at home. He drives a Toyota Corolla, which he owns free and clear. He wears clothes until they’re worn, then shops at Goodwill for replacements, often picking up Jim’s barely-worn clothes. At the end of the year, he usually has about $5,000 of his income left over, which he sticks into his stock investments which earn 8% a year.

In ten years, Jim’s net worth hasn’t grown a cent. In those same ten years, Bill has $72,000 in the bank.

At the twenty year mark, Jim’s net worth still hasn’t grown a cent. In those same twenty years, Bill has built up $228,098 in the bank.

At the thirty year mark, Jim’s still breaking even. Bill, on the other hand, has $566,416 in the bank.

At age sixty five, Jim hasn’t accumulated a cent and will be working for the man for the rest of his life. At the same age, Bill has $1.3 million in the bank and can do whatever he wants for the rest of his life – and probably already started doing that a few years earlier.

It doesn’t matter how much you earn. It matters how much you save.”

Glen Engel-Cox says:

Yes, it is important to save; the math there is incontrovertible. But it’s much easier for someone with a $100k salary to save $5k a year than someone with a $35k salary (5% of income versus 14%).

And, really, to drop the other shoe, both Jim and Bill drop dead at age 70, which means that Jim spent 45 years working and enjoying his life while Bill spent 40 years skimping and 5 years wondering how long his $1.3 million was going to last given the 5% inflation that occured over the 40 years he saved.

Save, but don’t forget to live.

——–

To play devil’s advocate and reinforce the theme, there’s the case of Joe.

At age 25, Joe makes $200k a year. he lives in a large house in the suburbs that he took a balloon mortage on. He traveled so much in his business that his first two wives divorced him, for which he pays alimony to take care of his three children. He eats out and drinks too much, and has weight and other health problems. He drives an SUV that gets only 8mpg, which he bought outright, but then trades in and buys another one every four years. He spends money on clothes, jewelry, and electronics, not to mention vacations and gambling. He not only spends everything he brings in, he’s racking up a debt of $35k every year.

I’ll let you write the part of the ten year, 20 year, and 30 year mark in Joe’s life.

Life choices do matter. Live, and save, within your means.